The job of a F&I Manager is an often coveted position in dealerships, and for good reasons! Finance Managers can make high incomes while enjoying the comforts of working inside an office. But the position requires high skill levels when it comes to structuring deals for a customer’s maximum benefit, presenting options to customers in terms they can understand, working effectively with lenders, and much more. In many cases, F&I Managers learn from their predecessors which sometimes results in knowledge gaps or even the adoption of bad habits. This can lead to unnecessary unwinds, deals lost, and unhappy customers.

A better approach for aspiring Finance Managers is to learn all aspects of the F&I job description from F&I experts, so they come away with no knowledge gaps and the ability to close more deals for higher profits while keeping customers happy 100% of the time. That’s why many up and coming Automotive professionals are choosing to learn the job through certification programs instead. But what can they possibly learn in a F&I Certification program that’s better than learning on the job?

We’re about to tell you.

The Complete Automotive F&I Certification Program at The College of Automotive Management (CAM) was founded in 1992 by owners of a F&I company. Their goal was to create a program that would teach current and future Finance Managers how to be top level professionals in that position, understanding all the details necessary to be excellent at their jobs without knowledge gaps, and avoiding the potential of inheriting bad habits. Therefore, since its inception in 1992, this program still offers the most comprehensive Finance and Insurance Manager (F&I Manager) training in the industry.

If you’re ready to launch a six-figure career as a top-earning F&I Manager or F&I Director, this is the ideal program to help you achieve that goal and prepare you 100% to be a top Finance Manager right out of training! To help you get started, we have broken down each of the five courses contained in this program to give you a sense of what you’ll learn:

Course #1 — F&I Products, Professional F&I Selling Process and Disclosures

CAM’s courses feature industry leading experts, who are recognized for their ability to provide cutting-edge F&I Training while delivering insight into the world of Finance and Insurance Management. These leaders will provide students with invaluable advice and techniques grounded in real-world experience.

Our platform allows you to learn various F&I presentation skills and practice role-playing scenarios that simulate real-life industry conversations. Furthermore, these presentations, scripts, and techniques are demonstrated by the experts, so you’ll be ready to take the showroom by storm and with confidence!

This course also includes presentations that explain the features and benefits of popular F&I products and the suggested methods for helping customers understand why the value of each product exceeds its cost.

Becoming a top-earning F&I Manager requires a quick and efficient completion of tasks. This course is designed to build your confidence through a proprietary F&I sales process that creates happy customers and produces maximum profits.

Course #2 — Loan Underwriting and F&I Administration (Includes F&I Director Training)

Successfully selling F&I products is a small part of an F&I Manager’s responsibilities. Professional F&I Managers and F&I Directors must know how to work with lenders, structure deals based on lenders’ guidelines, interpret credit reports and execute on all administrative aspects of the job, all while remaining in full compliance with state and Federal laws. Furthermore, Finance Managers must possess a deep understanding of loan underwriting guidelines.

The Loan Underwriting and F&I Administration course also includes training on important law contracts commonly used in dealerships today: the 553 simple interest contract, add-on contracts, and the difference between the two. You’ll learn how to adequately disclose each item of the contract while remaining legally compliant. This will ensure your customers understand every aspect of the sale before they leave the dealership happy.

This course will continue with Loan Underwriting for A&B Lenders, including vital procedures for completing advanced budget calculations. To become successful at dealing with lenders, you will need to learn the logic behind standard credit scoring methods and the methods of credit score interpretations, all of which is covered in this course.

You will leave this comprehensive course armed with the knowledge to better serve your customers while overcoming common lender objections.

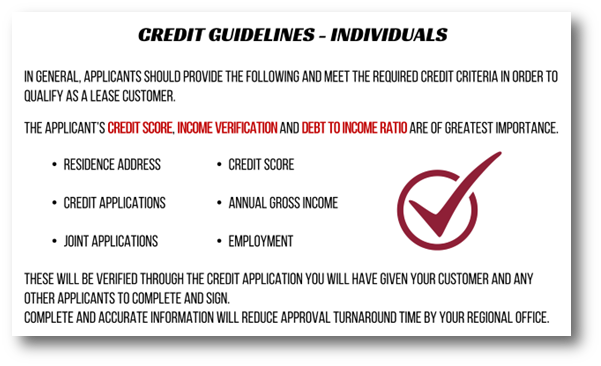

Course #3 — Leasing Master Class: Leasing Structures, Presentations and Disclosures

Many customers and salespeople shy away from leases simply because they don’t understand them. In fact, leasing can be an extraordinary way for customers to finance vehicles, and can even add valuable price protections for those who choose to buy them out! Beyond that, leases create guaranteed future used car inventory for Dealers, making them a fantastic option for everyone involved.

That’s why CAM dedicates an entire course to the proper structure, presentation and disclosure of leasing. No professional F&I Training would be complete without this!

Our Leasing Master Class includes proper lease terms and accurate lease calculation methodologies. Many lease calculation software programs are not accurate to the penny, which often results in potentially unenforceable lease agreements. In this training, you will learn to identify those inaccuracies. Furthermore, if you find yourself working a deal when a power outage occurs, you’ll be able to calculate and structure the deal by hand using the tools contained in this course!

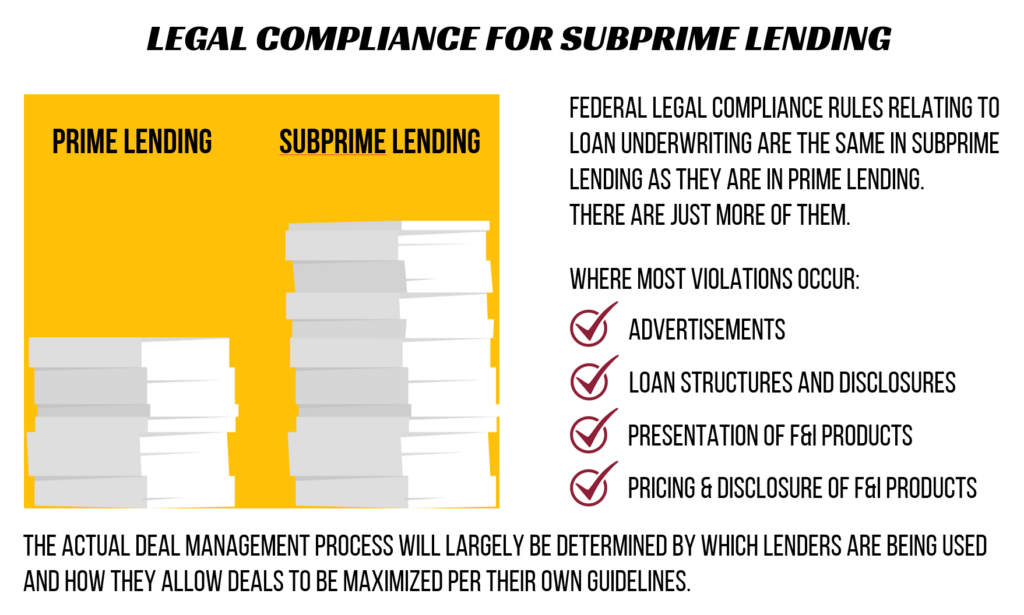

Course #4 – Subprime (Special Finance) Structures, Presentations and Disclosures

This course dives deep into the different ways lenders calculate income and the types of proof of income that subprime lenders may require for funding. Students of this course will enjoy the distinct advantage of structure a number of subprime deals using their new skills of advanced lender guideline interpretation.

Students will also learn how to obtain and interpret proof of income along with proof and verification of residence. They will also learn important tax return interpretations that are used by lenders prior to final delivery so obstacles do not come up later in the game. Other essential things students will learn includes improved management of bankruptcies, charge-offs, judgments, handing first-time or self-employed buyers, and other loan underwriting techniques that provide exceptional profit and relationship opportunities!

Finally, this course goes deep into credit bureaus and interpretations of credit reports, so students gain a complete understanding of how to approach those properly in the real world.

The combination of skills taught in this course is so comprehensive that graduates will be able to structure the toughest subprime deals for approval, creating happier customers, more referrals, and higher incomes for themselves!

Course #5 – Federal Compliance and Ethics (CA Version Available, too)

Now more than ever, employers are seeking employees who are certified in Federal Compliance and Ethics. This is even more important for Finance Managers, the nature of whose jobs require an in-depth understanding of what the laws allow in regards to transparency, disclosure and beyond.

Therefore, the Federal Compliance and Ethics course included in the Finance Manager Certification program covers dozens of Federal laws and regulations pertaining specifically to automotive retailing, financing, advertising, used vehicles, oral statements, customer privacy and loan origination, including FTC Safeguards Compliance Rules and their ongoing updates as they occur.

Graduates of this course will be able to reduce or even eliminate liability for themselves and their employers due to the comprehensive nature of this training.

CAM also offers a second version of this course that covers laws specific to the state of California, so graduates in all 50 states can be assured that they have what they need to operate in a manner that meets or exceeds the requirements of regulatory bodies.

All of this information is critical and will help finance managers obtain the data they need to make intelligent and successful decisions when structuring deals and presenting them to customers on vehicles they can truly afford.

If you’re serious about developing the skills you need to be a top finance manager, start your journey towards this highly rewarding career today! You can enroll in CAM’s Complete Automotive F&I Certification program any day of the year, as the content is designed for working professionals and is available online, on demand. The entire certification program can be completed in approximately 30 hours at your convenience, and can be reviewed as many times as you’d like!

And when you’re finished, you’ll be part of an elite group of CAM graduates who are preferred by employers all across the US and Canada!

Have questions? Call us at 888-857-4411 to speak with a Coach about your career goals. We look forward to your success!