Jesse George was already working in automotive sales at the age of 20 when he contacted the College of Automotive Management. As the primary caretaker for his mother who was ill, he was looking for the best and most expedient way to grow, advance his career and increase his income to best care for her.After considering all of his options, Jesse wisely determined that getting a college-level automotive education was the most efficient way to do that.Jesse is someone who focuses on excellence, and is not a corner-cutter. So he enrolled in all eight of CAM’s courses and began his life-changing education in mid-January of 2020.“I don’t settle for mediocrity,” said Jesse. “Anything worth doing is worth doing beyond 100% of my effort.”It didn’t take long for him to complete his first few courses and apply what he learned in his sales position. Immediately, he began experiencing greater success due to the concepts and processes he was learning in CAM’s courses.

Jesse George was already working in automotive sales at the age of 20 when he contacted the College of Automotive Management. As the primary caretaker for his mother who was ill, he was looking for the best and most expedient way to grow, advance his career and increase his income to best care for her.After considering all of his options, Jesse wisely determined that getting a college-level automotive education was the most efficient way to do that.Jesse is someone who focuses on excellence, and is not a corner-cutter. So he enrolled in all eight of CAM’s courses and began his life-changing education in mid-January of 2020.“I don’t settle for mediocrity,” said Jesse. “Anything worth doing is worth doing beyond 100% of my effort.”It didn’t take long for him to complete his first few courses and apply what he learned in his sales position. Immediately, he began experiencing greater success due to the concepts and processes he was learning in CAM’s courses.

Implementing new skills from CAM’s courses right away pays off

After completing one course in particular, CAM’s unique and comprehensive course on Subprime (Special Finance) Structures, Presentations and Disclosures, Jesse used his new skills to make a deal that would not likely have happened otherwise.

“This course may very well have been the most beneficial to me personally so far,” said Jesse. “It would justify a rating better than excellent if such a thing were to exist.”

Jesse went on to share this story:

“Today, one of my credit challenged clients came in hoping to get into a new F150. I got a credit application early, and knew it was going to a challenge. Score was under 600 across the bureaus, previous repo from 2016, revolving accounts had high utilization, every limiting factor you could imagine. Hoping the rebates and incentives would help me out on an approval, we looked at a base model in the configuration he and his wife wanted. We go through the process and my GSM submits the application, as I still don’t have the authority to structure a deal and submit it on my own. Turndowns across the board. I have a switch piece in the back of my mind, a 2017 with 24,000 miles on it. My clients are heartbroken that they can’t get into the new truck, and my GSM is already telling me to go find someone that can buy something. Against his instructions, I asked my client to take a look at the pre-owned truck I had. It was an aged unit, and I happened to know that the advertised price had been reduced to nearly 100% of book in hopes of getting it off the lot and avoiding any more curtailments on the floorplan. They love the truck, and I go to work. The closest approval I had was from Santander, and they cut my deal by 13,000 on the new truck. I look at Santander’s guidelines, and nothing immediately disqualified them. I calculated all my figures exactly how the course taught me, and they were coming out in the green. At this point my GSM is visibly mad at me for staying with them after he told me to find someone else, but I show him my handwritten structure and convince him to rehash the deal using the used truck, assuring him that we’ve got a shot on this truck. Sure enough, the phone rings and it’s our buyer from Santander. My GSM updates route one and we have a green arrow. My GSM changed his tune in a hurry because I got a 60+ day old unit off the lot, and I have this course to thank for that. If it weren’t for me doing my own calculations as I learned in this course and being able to show my GSM that it falls into the guidelines so he’d resubmit it, I would have lost the deal (and the $500 flat for getting rid of an aged unit).”

Remarkably, this situation came up just three weeks after Jesse started his education courses with CAM. What an incredible way to put his new knowledge of subprime and special finance to use!

Just three weeks later, Jesse shared another success story with us:

“Today I had a client on a new F150, very adamant about the need for a discount. We test drove two different trucks, one of which was a 2019 model and already priced very aggressively. The other was a 2020 that was less than a week in our inventory. The client liked the 2020 truck, but the 2019 price. I asked my GSM to pencil the 2020 truck twice; both with no dealer discount, only applicable rebates. One pencil showed the Ford Credit option (Ford credit rebate, lower bottom line, higher interest rate at 60 and 72 months with 0, 1, and 2 thousand down. The other pencil showed outside financing with less rebate, higher bottom line, lower interest rate, and a 60, 72, 84 month options with the same down payments. I presented the pencils side by side and used the script provided in this course, just switching the word track up a little since it was dealing with two different finance alternatives rather than a purchase vs lease option. After using the word track I learned from the course, I held out my pen and said ‘do me a favor and circle the option that you’re comfortable with.’ He signed the first pencil with zero down at 84 months using outside financing, for a higher bottom line. The price objection disappeared, and just for good measure I had him draw a big X through the Ford Credit option himself to solidify his decision.”

But that’s not all he had to say about how beneficial CAM’s courses have been for him.

Jesse had glowing comments on each one of the courses he completed

F&I Products and Professional F&I Selling Process and Disclosures:

“My course is self-paid. However, I strongly believe that if my employer used this training method for the entire sales team there would be a drastic increase in both units as well as profit per copy. If the dealership as a whole adopted this process, I can guarantee that every F&I manager, salesperson and sales manager would see a bigger paycheck in addition to having lots of new friends and lifelong customers- instead of just me! The ability of a finance manager to calculate reserve income, interpret lender guidelines, and perform accurate advance/budget calculations provides multiple benefits. Understanding the percentages and figures for each specific customer will allow the finance manager to submit the application to the most relevant lenders from the start, depending on how the calculations fall within lender guidelines. A good understanding of these guidelines also provides the dealership with the opportunity to increase their back-end profit, as well as put deals together that may have been missed otherwise. For instance, if a deal were to lose $1,600 on the front, and the finance manager properly structured the deal to submit to a lender that allowed for a total of $1,500 back end products plus a total of $1,800 in reserve profit, a losing deal just became a $1,700 winner. This being said, if the same finance manager did not have a working knowledge of the programs and how to calculate the relevant percentages, the application could be submitted to lenders with no chance of approving the loan due to their guidelines, thus causing the dealership to lose the deal and writing the customer off as someone that could not obtain financing.”

Loan Underwriting and F&I Administration:

“As an ASM at my current dealership, this course was excellent. With a functional knowledge of what goes on in the business office, I can fine tune my selling and credit application collection process to ensure that the Finance Manager has everything they need to get the deal approved in a way that makes the most sense all around. My goal is to become a Finance Manager myself in the very near future, and I feel like this course has provided me a leg up for achieving that goal. My tuition is self paid, but it has been worth every penny so far. I intend to apply these concepts as a salesperson at the current time, and implement everything else in full as a Finance Manager in the future. Having no prior FandI Manager experience, I strive to put up the most impressive numbers possible as soon as I have the opportunity to show what this course has taught me so far.”

Subprime (Special Finance) Structures, Presentations and Disclosures:

“This course has provided me with not only a better understanding of subprime lending, but the people that require it as well. Obviously, not every client that walks into my showroom will have a 720 beacon. With the knowledge from this course I will be able to fine tune my approach to subprime clients and ensure they are treated fairly and their expectations are exceeded to their full satisfaction. Everything I’ve learned in this course makes me feel as though I’ll be an incredible asset to my employer as a future Finance Manager. With my understanding of how a subprime lender interprets bureau information, I’ll be able to quickly and efficiently structure deals to submit to my lenders with the most room for dealer profit, while making sure each and every customer is taken care of as well as possible. I can calculate all the necessary figures just as the lender does, thus raising the rate of approval from my lenders and building professional relationships with them. I feel as though my understanding of subprime finance will produce a stream of revenue for my dealership in its entirety where deals would have been lost by a less educated finance manager.”

Leasing Structures, Presentations and Disclosures:

Leasing Structures, Presentations and Disclosures:

“Excellent course as usual. The whitepapers and textbook material made it very simple to practice the lessons using the figures provided, and I feel as though I am more of an asset to my dealership for my understanding of leasing structures. Here in Georgia, lease customers are few and far between- and even more so for a domestic brand like Ford. I believe that I can capitalize on a previously untapped market in my area. So few salespeople I have encountered know how to structure a lease, and even fewer finance managers know how to perform the calculations or contract one. Previously, I avoided bringing up the lease option because I was unaware of how they worked, and therefore unable to explain the benefits. This course has given me the comprehension necessary to properly ‘sell’ a lease. Since I now have that ability, I hope to use it to distinguish myself in my local market and increase overall profitability for myself and my dealership.”

Sales Manager Desking, Presentations and Negotiations:

“As a salesperson, I believe this course has armed me with the ability to hone my negotiation skills, and will be an extremely valuable asset in the near future when there’s a need for me to provide a T.O. for one of my salespeople as I advance to a management position. I believe that the key to a compliant, professional presentation and negotiation strategy is rooted in your personal ethics. While a strategy may be compliant, it may not be ethical- which in my opinion is unprofessional. A professional finance manager, salesperson, or manager has the ability to properly explain each situation to a customer that may not be familiar with compliant practices, thus resulting in a comfortable, and educated consumer that you have now built a relationship with. It shouldn’t boil down to the dollar amount, but to your own morality. When you treat every customer with the moral and compliant standards you would want for yourself, your family, or your friends, your income will follow suit.”

Professional Selling, 365-Day Plan, Lead Management and Phone Training:

“Excellent content. The goals outline is extremely beneficial and I’ll still implement it into my daily routine. I believed myself to have strong phone skills prior to the course; but at this point I am producing appointments, and more often than not, a sale, from each phone opportunity I come in contact with. Since beginning these courses through the College in January, I’ve already noticed personal improvement. My sold units are tailing the ‘top’ salesperson that has been with the dealership at this location for over 10 years, when I’m working with a fresh customer base in a new city. I’ve increased my average profit per copy by $430 over January, and have a flawless CSI rating. I have already received my first referral. I’m currently leading the store in average gross by over $350 per unit.”

“Excellent training content. Without any formal compliance training as a salesperson at my dealership, I thought this course was excellent at explaining the specifics behind concepts I had a vague knowledge of to begin with. As an aspiring Finance Manager, I feel like this course will prove extremely advantageous on my path to further myself in my career and set myself apart in my field. One of the most prevalent concepts that applies to not only sales, but life in general is this- the same actions warrant the same results. If you want to improve, you have to do something differently. Whether it’s more calls, a different greeting, or tweaking your own process, something has to change in order for the results to improve from their current state. For me, it was my mindset and loving my customers. Those of us in the automotive industry are surrounded by constant negativity. ‘Water cooler’ talk with our coworkers about the last rock in our shoe customer that gave us a hard time. Chances are, the salesperson talking bad about that customer didn’t sell them. Why? Perhaps because they had the wrong mindset and they focused on their negative emotions, rather than loving their customer. This course as a whole has increased my gross average per vehicle drastically. For the month of February, I led the dealership with a $2,400 average per unit and sold two different referrals to households that I’d sold in the past. I intend to continue increasing my averages across the board by utilizing the foundation presented to me in the courses I’ve taken so far, and tweak them to be ‘me’. Fantastic content overall.”

Activating CAM’s unparalleled career assistance program

Jesse’s positive comments went on and on. He was thrilled with all that he had learned and throughout the process of his training, kept his mind open to all that the doors that could potentially open for him given his new skills.

“When presented with the opportunity, whether it be at my current dealership, another dealership, or placement outside of automotive retail, I am confident that the courses and lessons I have taken with the college will be of great benefit financially to both myself and my employer,” Jesse said.

“I feel as though the lessons and knowledge I have accrued from these courses have directly affected not only my mindset, but honed my professional skills as well. I have seen a tangible increase in profits, units sold, back end gross, and satisfaction scores since my enrollment with the college. I plan to continue this trend of growth as applicable to whatever field and position I find myself in, and become an undeniable asset to whomever first allows me the opportunity to show what I am capable of.”

In late Fall of 2020, a large but growing nationwide company by the name of ACV Auctions reached out to the College of Automotive Management, interested in hiring our graduates and including their nationwide open positions on CAM’s private job boards.

In late Fall of 2020, a large but growing nationwide company by the name of ACV Auctions reached out to the College of Automotive Management, interested in hiring our graduates and including their nationwide open positions on CAM’s private job boards.

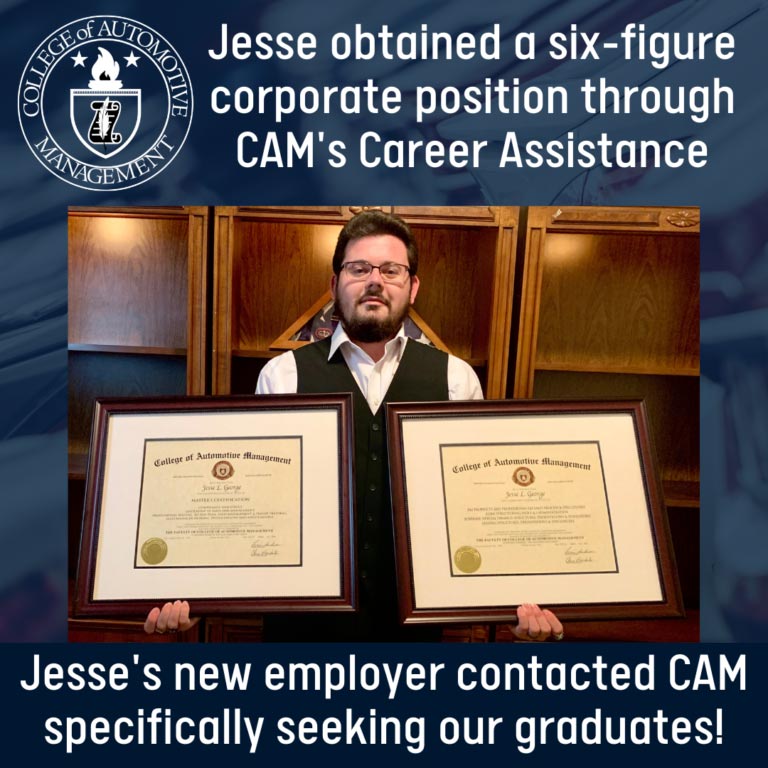

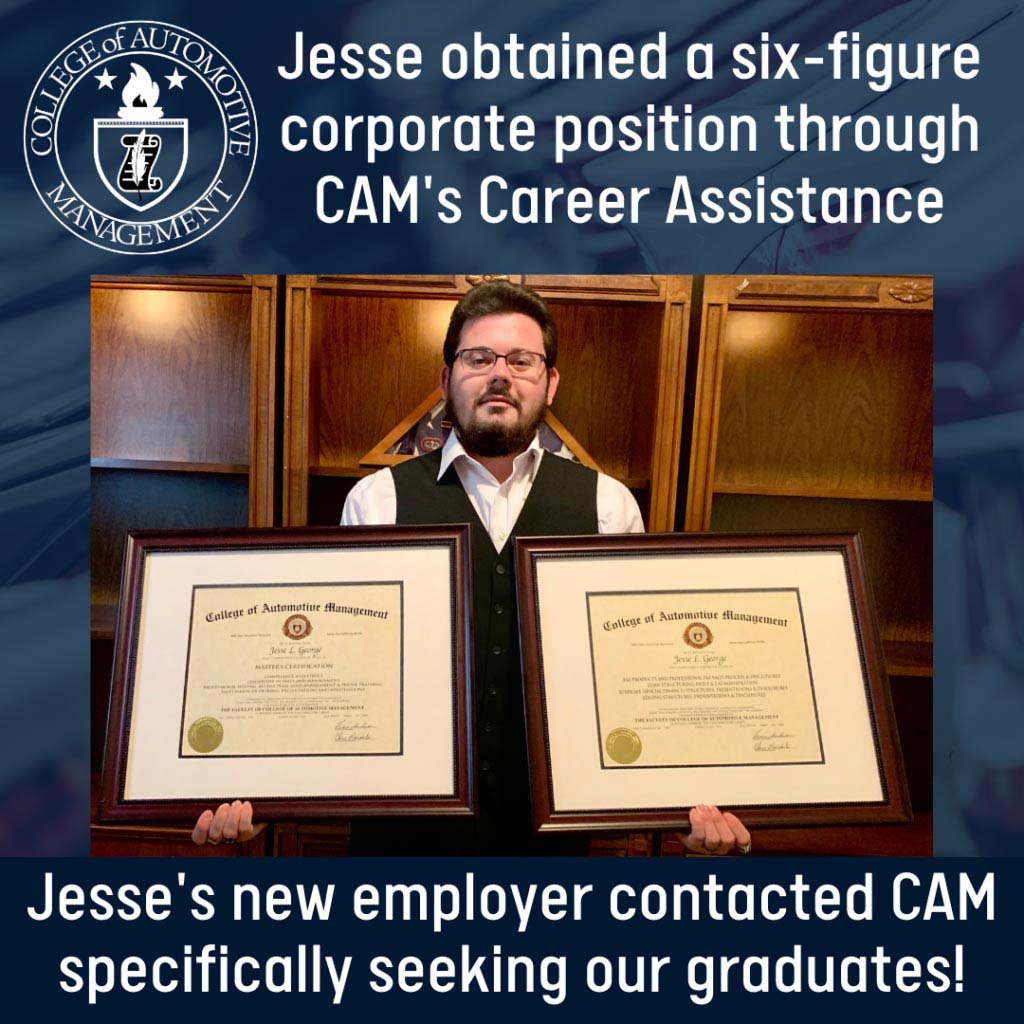

Shortly thereafter, Jesse’s career coach reached out to him and connected him with an open position in his area that ACV Auctions asked CAM to help them fill. Jesse, now a CAM graduate with his Double Master Certification, was excited about the opportunity and submitted his resume.

Upon receiving Jesse’s resume and recommendation from the College of Automotive Management, ACV Auctions scheduled an interview with Jesse.

Jesse was hired by ACV Auctions as a Territory Manager with a six-figure income, thanks to his education with CAM and their proactive approach to career assistance!

Jesse’s decision to invest in his personal and professional growth by completing all of CAM’s courses literally changed the trajectory of his life. Not only did he close more units with higher profits during and after completing his courses, he was able to take advantage of CAM’s unparalleled career assistance services to advance his career far beyond what he had imagined.

We are so proud of you, Jesse! Here’s to an amazing life and career in which you will positively impact the lives of others!

To learn more about CAM’s training programs or career assistance, call 888-857-4411.

Pingback: How much do Automotive F&I (Finance and Insurance) and Sales Managers Earn at Car Dealerships in 2021? - College of Automotive Management

Pingback: How The College Of Automotive Management's Career Assistance Program Can Help Graduates Secure A Six-Figure Career - College of Automotive Management